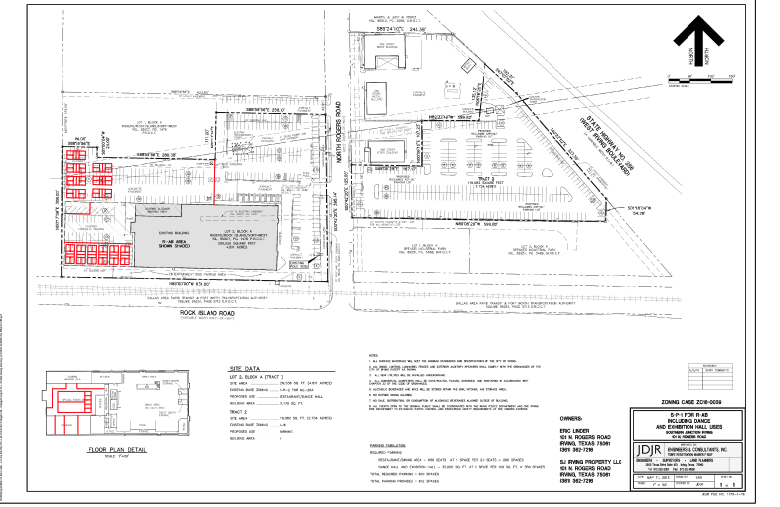

101, 200, and 300 n. Rogers Rd Irving TX

:

🏗 The Retreat at the 19th Hole — Irving, TX

A Hospitality-Driven Wellness Destination with Built-In Equity and Immediate Revenue

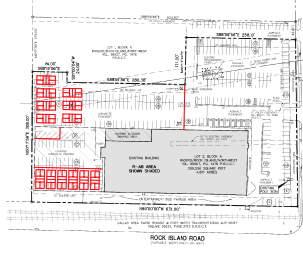

Gordon Cooper Real Estate Partners (GCREP) is acquiring and repositioning an 8-acre (346,382 SF) hospitality and wellness campus in Irving, TX. The site spans three contiguous parcels and over 70,390 SF of enclosed buildings, with ~28,000 SF of improved outdoor space primed for future enclosure and conversion to income-generating uses.

🔎 Campus Overview

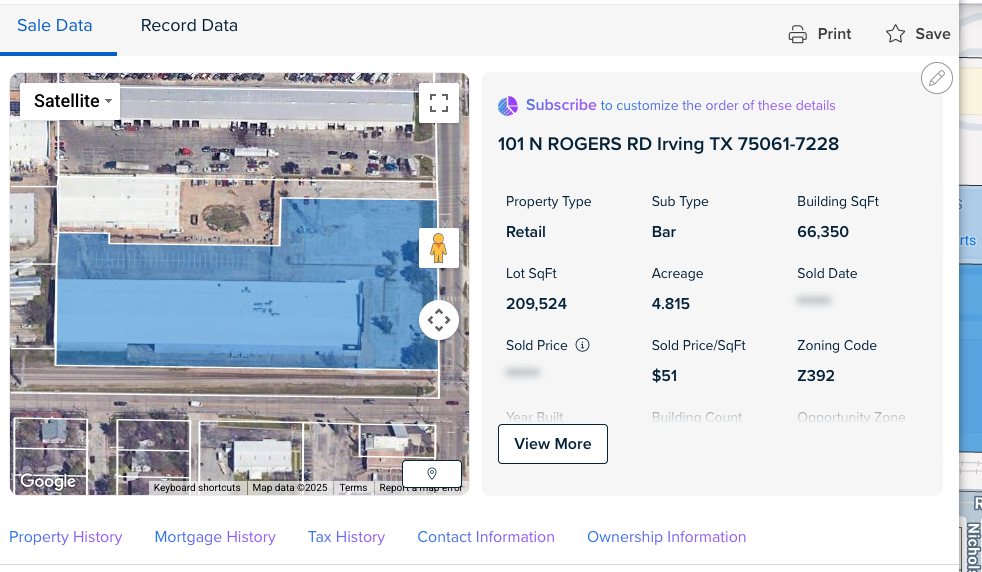

Main Venue (101 N Rogers Rd): 66,350 SF on 4.815 acres

Executive Office (300 N Rogers Rd): 4,040 SF on 0.41 acres

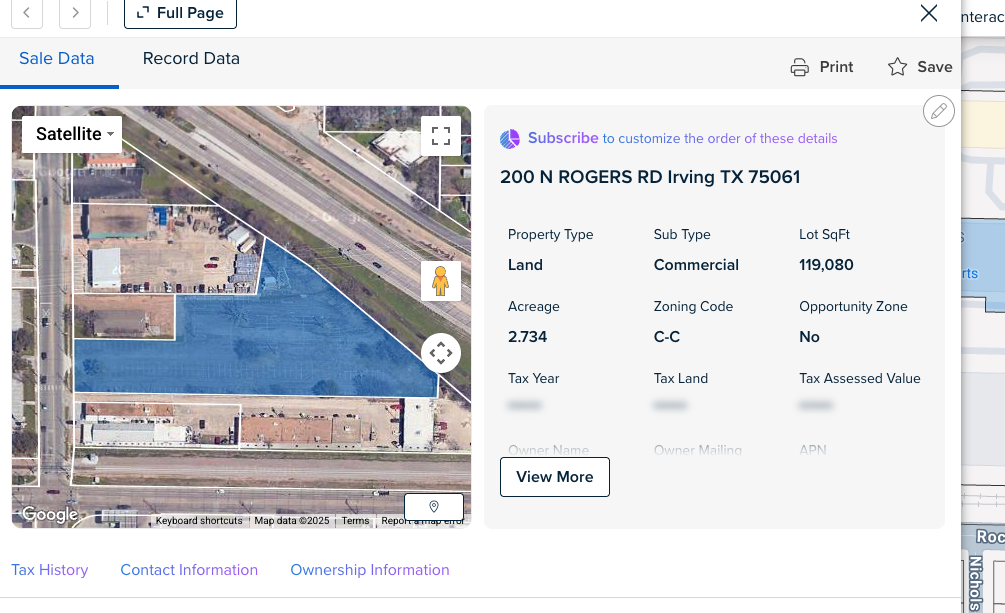

Commercial Land (200 N Rogers Rd): 2.73 acres (vacant)

Outdoor Amenity Zones: ~28K SF of improved hardscape (to be enclosed)

Fully Operational 30,000+ SF Event Center

4,000+ SF Restaurant + Commercial Kitchen with $1.2M+ in FF&E

Heavy equipment assets: RV, skid steer, scissor lift, trailers, mini-excavator

The previous operator underutilized over 60% of the site. GCREP will unlock new income streams by branding, optimizing, and eventually enclosing outdoor areas into usable indoor square footage.

🔑 Our Edge

Execution Team:

GCREP – master planning, capital strategy, and sponsor

Apex Genesis – licensed GC, internal construction delivery

Eloquent Hospitality – experienced operator of high-volume F&B venues

Rollout & Activation Plan:

Restaurant (event center) generates revenue on Day One

Sub-brands will be delivered in phased build-out:

Cart Girl Social (golf-themed F&B)

The Next Hole (golf sim facility)

Par & Ash (speakeasy cigar lounge)

Fore Wellness (spa & wellness)

The Courts at the Retreat (Pickleball and wellness)

Partnerships secured with:

Invited Clubs (ClubCorp)

NFL alumni + influencer activations

Local institutions for programming, memberships, and public health events

Enclosure of the 28,000 SF rear outdoor area to create climate-controlled, income-generating space — expanding the usable footprint and long-term asset value.

🧮 Financial Highlights

Ultra-Low LTV

At 44% LTV on a $27.7M stabilized valuation,

the project positions the lender with

exceptional collateral coverage

and minimal downside risk.

Massive Built-In Equity

$15.5M of equity is locked in at stabilization, demonstrating strong arbitrage and value-creation.

Strong Cash Flow

The 5-year lease profit delivers $4.6M in predictable, contract-backed income.

Total 5-Year Return

Combining equity capture and operating return, the project produces $28.5M+ in total upside over 5 years.

🏁 Exit Strategy

GCREP will execute a 6–18 month refinance via SBA or conventional debt backed by strong collateral, existing cash flow, and stabilized NOI.

Immediate income from event center and F&B

No permitting or TI delays for core operations

Construction already scoped and priced — led by in-house GC

Future upside from planned enclosure of outdoor space

| Metric | Value |

|---|---|

| Total Project Cost | $12.2M |

| As-Is Valuation | $17M |

| Stabilized Value | $27.7M (7% Cap) |

| As-Complete LTV | 44.0% |

| Built-In Equity | $15.5M+ |

| 5-Year Lease Profit | $4.6M |

| Total 5-Year Return | $28.5M+ |

Pictures of the interior of the property